how to pay indiana state estimated taxes online

Make a Payment via INTIME INTIME user guides are available if needed. Ready to access the Indiana Taxpayer Information Management Engine INTIME.

Indiana State Tax Information Support

When figuring your estimated tax for the.

. To make payments toward a previous tax year filing please select or link to the Individual Tax Return IT-40 payment option Select Tax Year 2021 2022 Select Filing Information Single Married Filing Jointly. This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247.

If you did make estimated tax payments either they were not paid on time or you did not pay enough to. Find Indiana tax forms. Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically.

Unlike the federal income tax system rates do not vary based on income level. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a. For more information visit INTIME.

All payments must be made with US. Indiana Department of Revenue. Ir a la herramienta ahora.

Estimated payments can be made by one of the following methods. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest. Rates do increase however based on geography.

For more information on the modernization. Search for your property Search by address Search by parcel number. You may qualify to use our fast and friendly INfreefile to file your IT-40 IT-40PNR or IT-40RNR directly through the Internet.

To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. Indiana has a flat state income tax rate of 323 for. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Access INTIME at intimedoringov. Htm and follow the prompts for making an estimated tax payment. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

01-20-2022 Individual Income Tax Filing Opens Jan. Will not have Indiana tax withheld or If you think the amount withheld will not be enough to pay your tax liability and. Take care of your Motor Carrier reporting plate renewal and permits online with DOR.

INtax only remains available to file and pay the following tax obligations until July 8 2022. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here. Write your Social Security number on the check or money order.

Once logged-in go to the Summary tab and locate the Make a payment hyperlink in the Account panel. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Indygov Pay Your Property Taxes This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

However if you owe Taxes and dont pay on. Thank you for your patience during this maintenance period. Estimated payments may also be made online through Indianas INTIME website.

Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax Paying online Filling out ES-40. To pay by credit card you may make your estimated tax payment online. You should also know the amount due.

The option to make an estimated payment will appear in the Payment. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. The tax bill is a penalty for not making proper estimated tax payments.

You can find your amount due and pay online using the intimedoringov electronic payment system. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply. Pay Taxes Electronically INTIME INTIME provides access to manage and pay individual income and various corporate and business tax obligations.

If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty. Send in a payment by the due date with a check or money order. Visit our website at wwwingovdor4340.

When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. The Indiana Department of Revenues DOR new online e-services portal INTIME now offers customers the ability to manage their tax account s in one convenient. The Indiana Department of Revenues DOR current modernization effort includes the Indiana Taxpayer Information Management Engine INTIME DORs e-services portal for customers to use when managing individual income tax business sales tax withholding and corporate income tax.

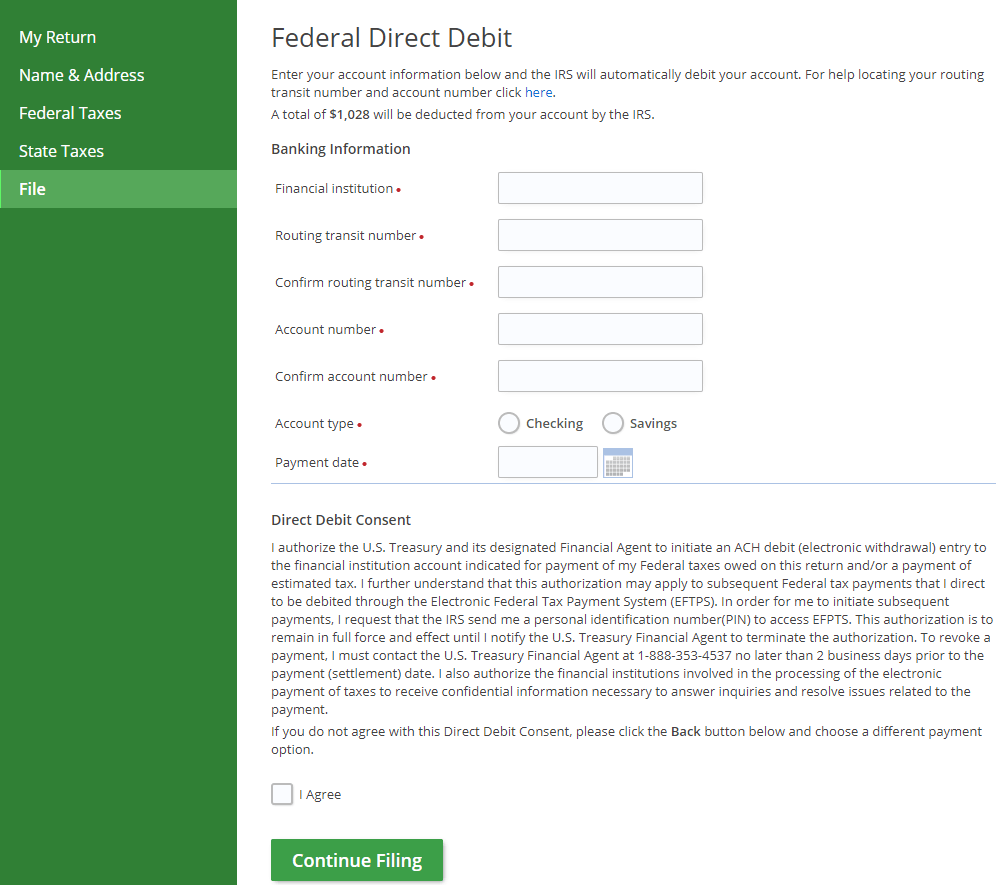

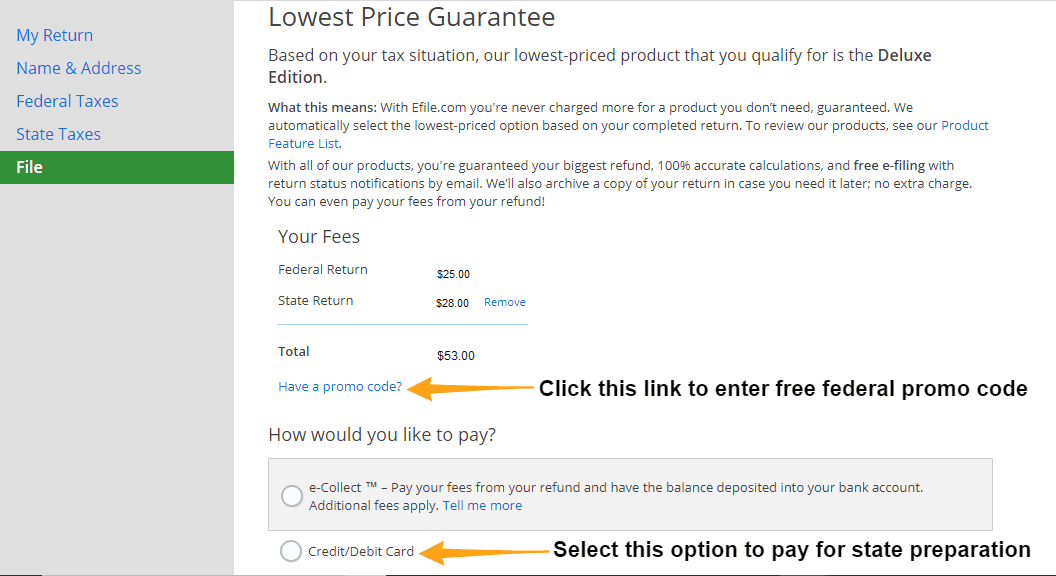

Indiana Income Taxes. When you receive a tax bill you have several options. If you have not yet filed your tax return when you reach the File section you have the option to either have the amount due debited from your bank account or you can select the option to mail a checkOr you can use the link below to pay your state taxes due.

If you expect to have income during the tax year that. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

In the top right corner click on New to INTIME. Contact the Indiana Department of Revenue DOR for further explanation if you do not understand the bill. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

Individual Estimated IT-40ES Payment Filing Information This option is to pay the estimated payments towards the next year tax balance due. To make a payment via INTIME. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date.

Payment Plan Set up a payment plan online INBIZ. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes.

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Where S My State Refund Track Your Refund In Every State Taxact Blog

Dor Indiana Extends The Individual Filing And Payment Deadline

Dor Keep An Eye Out For Estimated Tax Payments

Bookkeeping Is A Time Consuming Process For Many Entrepreneurs And Business People Spending Time On Bookkeeping Means Tak Finance Saving Finance Bookkeeping

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Indiana Dept Of Revenue Inrevenue Twitter

E File Indiana Taxes Get A Fast Refund E File Com

I Live In Indiana And I Have Worked In Kentucky T

2021 State Income Tax Return Prepare Online On Efile Com

Buffett Malone Explore Investment In Sprint Sources Investing World News Today Sprinting

Indiana Dept Of Revenue Inrevenue Twitter

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller